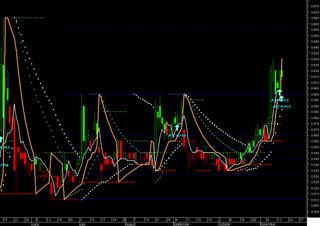

KLCI down 0.4% at 1026.16 on profit-taking, support at 1025 (chap ayam indicator). Decline attributed to fall in Maybank, down 1.7% at MYR11.30 on poor 1Q net profit, 0.5% fall in MISC to MYR9.15 and Gamuda's 0.8% fall to MYR4.74. Maybank's poor results aside, investors are also locking in profits from a broad range of construction, property and blue chips after the recent rally. The market is overbought. Investors will continue to sell until this is corrected.

Heh heh.. Alamak! The Chap Ayam Target for KLCI is in line with DEUSTCHE BANK lar!!.. or is it the other way around.. heh heh.

"Deutsche Bank overweight on Malaysia equities. In 2007 strategy report says bottom-up KLCI index target is 1,075, suggesting 9%-13% upside on total returns basis. 2006 EPS growth momentum has picked up to 12.2% (ex-MAS) from 9.6% in January. Market's dividend yield of 3.6% superior vs. regional average of 2.9%. Picks five 'high conviction' stocks to own into 2007 which are either industry leaders and/or are being restructured for the better; Tenaga, target MYR12.20; Bumiputra-Commerce, target MYR7.90; IOI Corp., target MYR18.70; Transmile, target MYR14.70; and KLCC Property target MYR2.90; . Key risks to market call - poor implementation of the 9MP and a sharp downturn in the economy."

Heh heh.. Alamak! The Chap Ayam Target for KLCI is in line with DEUSTCHE BANK lar!!.. or is it the other way around.. heh heh.

"Deutsche Bank overweight on Malaysia equities. In 2007 strategy report says bottom-up KLCI index target is 1,075, suggesting 9%-13% upside on total returns basis. 2006 EPS growth momentum has picked up to 12.2% (ex-MAS) from 9.6% in January. Market's dividend yield of 3.6% superior vs. regional average of 2.9%. Picks five 'high conviction' stocks to own into 2007 which are either industry leaders and/or are being restructured for the better; Tenaga, target MYR12.20; Bumiputra-Commerce, target MYR7.90; IOI Corp., target MYR18.70; Transmile, target MYR14.70; and KLCC Property target MYR2.90; . Key risks to market call - poor implementation of the 9MP and a sharp downturn in the economy."

DIALOG

Best Buy at 0.60/0.59.

For 15 Nov the closing price was 0.6150.

Overall, the bias in prices is: Upwards.

The projected upper bound is: 0.65.

The projected lower bound is: 0.59.

MASTEEL

Best Buy at 0.86/0.85

For 15 Nov the closing price was 0.8800.

Overall, the bias in prices is: Upwards.

The projected upper bound is: 0.91.

The projected lower bound is: 0.85.

THE TOMYAM SHOPPING LIST FOR TOMOLOW

1 comment:

Wahh! kerap masuk paper, dahsyat ler Tokey- HIDUP CHAP AYAM lol

UTUSAN MALAYSIA RABU 15 Nov 2006

---------------------------------

IK tertinggi lebih 10 tahun

KUALA LUMPUR 14 Nov. – Indeks Komposit Bursa Malaysia hari ini meningkat ke paras tertinggi lebih 10 tahun apabila mencapai 1,030.09 mata.

Kali terakhir IK mencecah paras tersebut pada 31 Julai 1997.

Menurut penganalisis Inter Pacific Securities Sdn. Bhd., Kamarulzaidi Kamis, peningkatan itu didorong keyakinan para pelabur terhadap pengumuman projek baru di bawah RMK-9 oleh Perdana Menteri, Datuk Seri Abdullah Ahmad Badawi semalam .

Kamarulzaidi berkata, aktiviti kemasukan secara besar-besaran pelabur runcit, pengurus dana tempatan dan asing dalam pasaran pada penghujung tahun, juga menjadi faktor kenaikan Indeks Komposit hari ini.

‘‘Ini memberi petanda bahawa mereka (pelabur asing dan tempatan) yakin terhadap pasaran tempatan menjelang tahun depan,’’ katanya kepada Utusan Malaysia di sini hari ini.

Kamarulzaidi berkata, Indeks Komposit kini dijangka berada pada paras semasa yang kukuh dalam tempoh sederhana.

‘‘Ia kini sedang menyasar kepada paras halangan yang baru iaitu 1,040 selepas berjaya melepasi paras 1,025 mata,’’ kata beliau.

Tambahnya, Perhimpunan Agung UMNO yang bermula sejak semalam yang menjadi topik perbualan rakyat negara ini juga memberi suntikan positif kepada pasaran tempatan minggu ini.

Post a Comment