"Most people would rather die than think; in fact, they do so." ~ Bertrand Russell

"Most people would rather die than think; in fact, they do so." ~ Bertrand RussellKLCI closed flat at 970.37, +0.66 point, in moderate volume, off intraday low of 967.89 despite intermittent profit-taking; local funds helped lift government-linked heavyweights while construction stocks gained on positive newsflow. Index is likely trade within 967-973 range Thursday.

Heavyweight BIMB Holdings supported the market on the back of the company unit Bank Islam's move to form a strategic partnership with Dubai Investment Group, but investor interest generated by such move was offset by profit-taking in Genting following its gains ahead of the submission of its proposal for Singapore's second casino resort.

Trading remains dull and unexciting, with little or no leads to lift sentiment. Investors just seemed uninterested in the market. Follow-through selling in selected blue chips are expected to continue tomorrow in counters like Genting, IOI Corp, and Tanjong. Trading is expected to remain generally quiet tomorrow ahead of Tenaga Nasional's announcement of fiscal year results after the market closes tomorrow.

The stronger volume and positive market breadth yesterday were mostly contributed by increased trading interest in speculative penny stocks and warrants . Hence, the present cautious market undertone should persist, as indicated by the persistent discount on KLCI futures.

For today, the CHAP AYAM INDICATOR selected VS Industry.

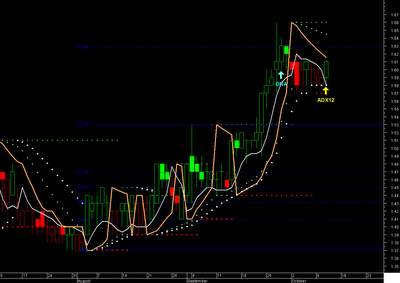

VS (6963)

Testing resistance 1.63. Potential uptrend continuation

For 11/10/2006 the closing price was 1.61.

Overall, the bias in prices is: Upwards.

The projected upper bound is: 1.67.

The projected lower bound is: 1.56.

Cut Loss: 1.51

Business Activity

INVESTMENT HLDG MFR ASSEMBLING AND SALE OF ELECTRONIC AND ELECTRICAL PRODUCTS AND PLASTIC MOULDED COMPONENTS AND PARTS

Recent News:

VS INDUSTRY ON FY2007 GROWTH - 04 Oct 2006

VS INDUSTRY responding Oct 3, 2006 to THE NST of same date which reported that the Company "... is set to grow its Net Profit by more than 30% in 2007..." replied that the growth target is based on the recently expanded production capacity of about 20%.

VS INDUSTRY HOPES TO GAIN FROM UK CUSTOMER CONSOLIDATION - 21 Sept 2006

VS INDUSTRY INVESTS FURTHER IN ITS INDON PLANTATION UNIT - 18 Aug 2006

VS INDUSTRY INCREASES INVESTMENT IN INDON PLANTATION - 05 May 2006

VS INDUSTRY SEES MAIN CONTRIBUTION FROM PLASTIC PARTS - 24 Jan 2006

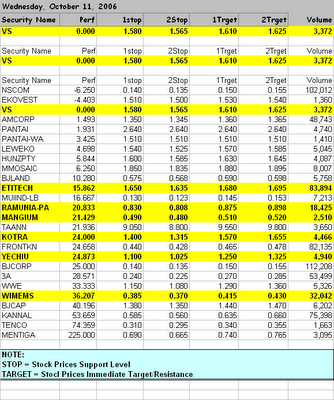

.. and the TOMYAM RAW ANALYSIS FOR TODAY

HAPPY WHATEVER LAH!!

2 comments:

Tauke,

Your CHAP AYAM INDICATOR really can fly very high one. Latexx hit your target up almost 20% today! :)

zen

he he... the time has spoken.. hope not just a one time luck bro.

TS

Post a Comment