"Time is never wasted when you're wasted all the time." ~ Catherine Zandonella.

"Time is never wasted when you're wasted all the time." ~ Catherine Zandonella.Share prices closed higher after the government released data showing a trade surplus for August of over RM10 bil with exports up almost 15 pct year-on-year, bolstering sentiment further in a market already initially upbeat after Wall Street's record-breaking performance overnight.

Malaysian central bank governor Zeti Akhtar Aziz said that inflation rate may trend below 3 pct next year provided additional support. The Kuala Lumpur Composite Index (KLCI) was up 4.83 points or 0.50 pct at 968.89.

Sentiment improved further on the government's report that Malaysia's exports grew 14.8 pct year-on-year in August to RM53.49 bil, after the rally on Wall Street lent momentum to the local bourse, which had been lackluster due to uncertainty about its near-term prospects.

Wall Street's rally on the back of a perception that the US Federal Reserve may cut its key interest rate next year played a bigger factor in the market's rebound. The effect from Wall Street is finally coming through, but perhaps more important is the perception by US traders that the Fed may cut interest rates next year following (Fed chairman Ben) Bernanke's remarks that the US housing market is in a slump.

However, it will take a stronger catalyst to push the market up on a more sustainable basis. The market would perform much better after the festive holidays, which are about three weeks away.

The market got a further boost today when central bank governor Zeti Aziz said that inflation rate could trend below 3.0 pct if current economic conditions prevail and oil prices continue to weaken.

Malaysian central bank governor Zeti Akhtar Aziz said that inflation rate may trend below 3 pct next year provided additional support. The Kuala Lumpur Composite Index (KLCI) was up 4.83 points or 0.50 pct at 968.89.

Sentiment improved further on the government's report that Malaysia's exports grew 14.8 pct year-on-year in August to RM53.49 bil, after the rally on Wall Street lent momentum to the local bourse, which had been lackluster due to uncertainty about its near-term prospects.

Wall Street's rally on the back of a perception that the US Federal Reserve may cut its key interest rate next year played a bigger factor in the market's rebound. The effect from Wall Street is finally coming through, but perhaps more important is the perception by US traders that the Fed may cut interest rates next year following (Fed chairman Ben) Bernanke's remarks that the US housing market is in a slump.

However, it will take a stronger catalyst to push the market up on a more sustainable basis. The market would perform much better after the festive holidays, which are about three weeks away.

The market got a further boost today when central bank governor Zeti Aziz said that inflation rate could trend below 3.0 pct if current economic conditions prevail and oil prices continue to weaken.

SIMEENG (2992)

Better bet on the pullback to 1.43/1.40 (Highly speculative/High Risk)

For 5/10/2006 the closing price was 1.47.

Overall, the bias in prices is: Upwards.

The projected upper bound is: 1.55.

The projected lower bound is: 1.40.

Business Activity>

ENGR DESIGN AND FABRICATION OF OFFSHORE STRUCTURES FOR OIL & GAS INDUSTRY SYSTEMS INTEGRTION TRADING AND SRVCS BLDG AND CIVIL ENGR CONSTRUCTION

Recent News>

SIME ENGINEERING AWARDED THAI POWER PLANT UPGRADE PROJECT - 03 Oct 2006

RAMUNIA CONFIRMS TALKS ON SALE TO SIME DARBY - 02 Oct 2006

SIME ENGINEERING BIDS FOR JOBS WORTH RM3BIL - 28 Sept 2006

RAMUNIA HOLDINGS DENIES THE STAR REPORT ON TAKEOVER BY SIME ENGINEERING - 27 Sept 2006

SIME ENGINEERNG AWARDED RM320M OIL PLATFORM PROJECT - 02 August 2006

SIME ENGINEERING AWARDED RM1 BIL. OIL & GAS PROJECT - 27 July 2006

RAMUNIA-PA (7206PA)

If Resistance 0.80 Broken, Next Target is 0.85/0.90

For 5/10/2006 the closing price was 0.79.

Overall, the bias in prices is: Upwards.

The projected upper bound is: 0.90.

The projected lower bound is: 0.69.

PUNCAK (6807)

Testing Immediate Resistance 2.95/3.00

Support 2.85/2.75

For 5/10/2006 the closing price was 2.8900.

Overall, the bias in prices is: Upwards.

The projected upper bound is: 3.02.

The projected lower bound is: 2.77.

Business Activity >

OPERATION MAINTENANCE CONSTRUCTION

Recent News >

PUNCAK NIAGA UNITS TO SPEND A RM259M FOR INFRA UPGRADE - 22 Sept 2006

PUNCAK NIAGA ASKS FOR TARIFF HIKE - 26 July 2006

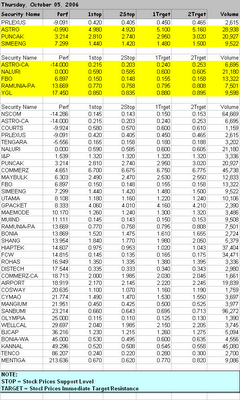

THE TOMYAM RAW ANALYSIS FOR 5 Oct 2006

Yeeehaa!!

No comments:

Post a Comment