"Even if you are on the right track, you will get run over if you just sit there. " ~ Will Rogers.

"Even if you are on the right track, you will get run over if you just sit there. " ~ Will Rogers.Technical indicators for the KL Composite Index (CI) are pointing towards a bullish bias in the near term. The effect of rallies in the US and regional stock markets is filtering through to the local bourse. Strong August trade surplus and export numbers, coupled with the moderating inflation outlook given the slump in crude oil prices, have boosted market sentiment.

Bank Negara governor Tan Sri Dr Zeti Akhtar Aziz was quoted as saying last week that inflation could average less than 3% next year if the price of crude oil continues to fall and the current economic conditions prevail. On the broader market, the positive market breadth and strong growth in trading volume, if sustained, will enhance bullish momentum for a breakout above the CI's formidable double-top of 970.

For next week, market would continue to focused on penny stocks. Index could trade in 967-973 range Monday as KLCI "found it tough even to reach 971 Friday.” More rangebound trade is expected next week as the market seems quite detached from the DJIA's record highs plus during Muslim fasting month, no major corporate developments expected.

Believe it or not!!! Fibonacci Projection Method suggested that "if KLCI could maintain above 970 next week", the next target would 1,002 point.

KLCI DAILY CHART

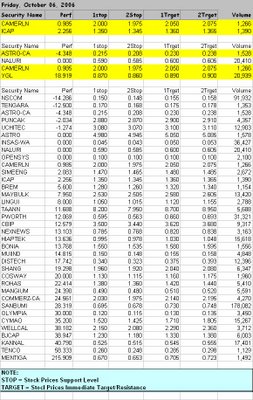

TOMYAM RAW ANALYSIS AS AT FRIDAY OCTOBER 4, 2006.

Happy Monday!

No comments:

Post a Comment