You can't have everything. Where would you put it? ~ Steven Wright

You can't have everything. Where would you put it? ~ Steven WrightShare prices closed slightly lower in listless trade with volumes remaining thin, as investors continue to stay on the sidelines ahead of the long festive holidays from this weekend. The Kuala Lumpur Composite Index (KLCI) was down 1.34 points or 0.14 pct at 975.89.

The benchmark possibly trade within 975-980 band tomorrow, led by gains in construction stocks. September inflation data came in within expectations, rising 3.3% on year, reducing likelihood of rate hike by central bank. Offer by IJM Corp to takeover rival construction firm Road Builder for RM1.56 billion or RM3/share expected to boost construction sector tomorrow while consumer related stocks, property and blue chips may rise in mild bargain-hunting after recent consolidation

The index is expected to move in a tight range but sentiment is likely to improve next month following the holidays. The market would stabilize after next week's festive holidays. As investors prepared for the upcoming festive season, local funds are liquidating some investments for the expected redemptions of funds.

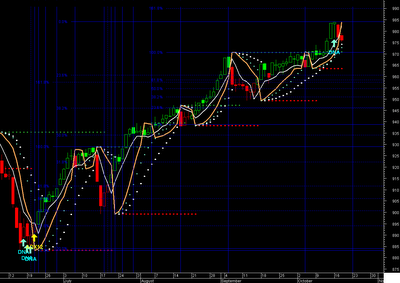

KLCI

Getting weak, dropped below parabolic line. Expected to stuck between 970-985 for a while. Important support is at 970.

For 18/10/2006 the KLCI closed at 975.8900.

Overall, the bias in prices is: Upwards.

Short term: Prices are stalling.

Intermediate term: Prices are ranging.

The projected upper bound is: 986.65.

The projected lower bound is: 966.60.

No comments:

Post a Comment