LMCEMNT (refer to previous posting) dah breakout resistance 0.85 to close at 0.86. However HEVEA (refer to previous posting) did pullback to 1.43 (target 1.40) before menaged to close at 1.47 - game still on. Untuk hari ni, banyak saham dah dalam overbought zone - risk dah tinggi sikit, so kena lebih berhati-hati. Antara saham yang menunjukkan +ve signal adalah seperti berikut:

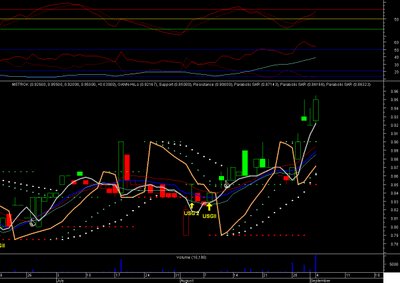

METROK (6114)

Buy on pullback to 0.92/0.87 (High risk/overbought condition)

For 4/9/2006 the closing price was 0.9500.

Overall, the bias in prices is: Upwards.

The projected upper bound is: 1.00.

The projected lower bound is: 0.90.

Stop Loss: 0.86

Business Activity:

PROJECT & BUILDING MANAGEMENT PROPERTY DEVELOPMENT & INVESTMENT HOLDING

Recent News:

METRO KAJANG HOLDINGS released Aug 29, 2006 its 3Q-FY06 results ended Jun 30, 2006 as follows:

1. YTD Revenue - 3Q-FY06 - RM201.6m (+22.3%)

2. YTD PBT - 3Q-FY06 - RM49.8m (+49.4%)

3. YTD PATMI - 3Q-FY06 - RM35.6m (+61.3%)

Property and Construction division remained the largest contributor which reported Operating Profit of RM34.5m for the 9-months (+31.1%). The property results were better due to the well-received "Pelangi Damansara 11" apartment project which sold 646 units of the 648 units available. The "Avernue One" 6-storey shop-office project with a Sales Value of RM33.0m has also been well-received with 81 of the 84 strata units sold. The Property Division also received good response from the "Pelangi Semenyih" and "Taman Bukit Mewah" projects.

The Hotel & Club Division reported an Operating Profit of RM5.5mfor the 9 months (+17%). The Furniture Division turned out an Operating Profit of RM1.3m as it benefitted from higher-margin upholstery products. The Trading Division which is involved in building materials recorded an Operating Profit of RM2.2m (+100%). The Services Division (including food manufacturing) turned in an Operating Profit of RM1.0m compared with the RM2.4m loss previously.

The Company is experiencing a healthy cash flow and has minimal net borrowings and had recently declared a first Interim Gross Dividend of 5 sen per share.

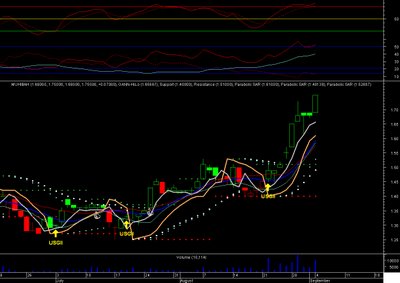

MUHIBAH (5703)

Buy on pullback to 1.66/1.60 (High Risk/Overbought Condition)

For 4/9/2006 the closing price was 1.7500.

Overall, the bias in prices is: Upwards.

The projected upper bound is: 1.85.

The projected lower bound is: 1.66.

Stop loss: 1.48

Business Activity

INVESTMENT HLDG CIVIL MARINE AND STRUCTURAL ENGR CONTRACT WORKS CONSTRUCTION OF BRIDGES HEAVY CONCRETE FOUNDATIONS FACTORY COMPLEXES

Recent News:

MUHIBBAH LISTING OF FAVELLE FAVCO ON AUG 15 2006 - 15 August 2006

MUHIBBAH ENGINEERING AWARDED RM48M PENANG BRIDGE WIDENING PROJECT - 04 August 2006

TONGHER (5010)

Buy on pullback to 3.20/3.00(High Risk/Overbought Condition)

For 4/9/2006 the closing price was 3.4000.

Overall, the bias in prices is: Upwards.

The projected upper bound is: 3.61.

The projected lower bound is: 3.22.

Stop loss: 2.98

Business Activity

MFR & SALE OF NUTS BOLTS AND SCREWS OF ALL TYPES OF IRON AND STEEL

No comments:

Post a Comment