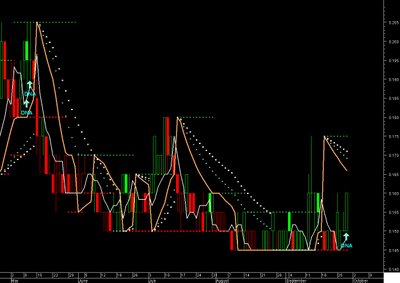

Share prices closed firmer led by selected blue chips on interest from local funds. KLCI was up 2.56 points or 0.26 pct at 968.88, off its intraday high of 970.79 in morning trade.Trading volume was 490.16 mln shares valued 702.13 mln rgt. Local funds seem to be finally coming back in the market, with strong plays in blue chips especially big capitalized stocks like Malayan Banking and Genting. This seems to be a good development for the market, however the gains can be sustained as profit-taking is expected to cap gains above the 970 points level. If no follow-through buying from local funds in the next few days, then profit-taking could likely push the index back down to 960 points; and if this (support level) is broken, it could fall to 955 points followed by 950 points.

Aiiyah! Hopes for small fish, keep on getting big fish. This is what people called Stock Market. Thank God!

Managed took some profit on JOTECH & MANGIUM today. However, SYMPHNY continue sleeping, accumulate more at 32 sen. Dunno can go or not (may be kena pick up).

Actually, I dunno what more to buy today. Spent time watching Puncak-Wa, Ramunia-Pa - afraid to go in. Watch some more, found very heavy moving counter (FBO) crawling slowly back to 16 sen. To buy or not to buy?

FBO (2097)

Better bet at 0.15 and below - Trading play - Up 5 sen (1 bid) lari kuat-kuat.

Probably cannot contra.

Business Activity:

PROPERTY DEVELOPMENT CONTRACTOR INVESTMENT HOLDING

Recent News:

FURQAN TERMINATES PURCHASE OF UNIT - 15 Aug 2006

FBO UNIT IN KELANTAN COMMERCIAL DEVELOPMENT - 07 Jul 2006

FURQAN BUSINESS RECEIVES PROFIT GUARANTEE PROPOSAL - 10 May 2006

FURQAN UNIT TO DISPOSE LANF FOR RM15M - 12 Apr 2006

And Last But not Least

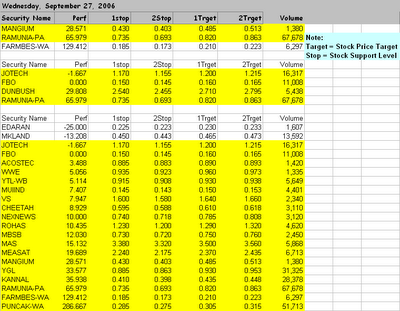

THE TOM YAM RAW ANALYSIS FOR 28 Sept 2006

Aiiyah! Hopes for small fish, keep on getting big fish. This is what people called Stock Market. Thank God!

Managed took some profit on JOTECH & MANGIUM today. However, SYMPHNY continue sleeping, accumulate more at 32 sen. Dunno can go or not (may be kena pick up).

Actually, I dunno what more to buy today. Spent time watching Puncak-Wa, Ramunia-Pa - afraid to go in. Watch some more, found very heavy moving counter (FBO) crawling slowly back to 16 sen. To buy or not to buy?

FBO (2097)

Better bet at 0.15 and below - Trading play - Up 5 sen (1 bid) lari kuat-kuat.

Probably cannot contra.

Business Activity:

PROPERTY DEVELOPMENT CONTRACTOR INVESTMENT HOLDING

Recent News:

FURQAN TERMINATES PURCHASE OF UNIT - 15 Aug 2006

FBO UNIT IN KELANTAN COMMERCIAL DEVELOPMENT - 07 Jul 2006

FURQAN BUSINESS RECEIVES PROFIT GUARANTEE PROPOSAL - 10 May 2006

FURQAN UNIT TO DISPOSE LANF FOR RM15M - 12 Apr 2006

And Last But not Least

THE TOM YAM RAW ANALYSIS FOR 28 Sept 2006

HAPPY HUNTING!!

No comments:

Post a Comment